The European Central Bank (ECB) believes that the impending digital version of the euro should emphasize online and peer-to-peer payments. In a recent online post, the financial organization known as the Eurosystem indicated that effective support for online transactions should take precedence over any of the other prospective applications of the digital euro.

Tax contributions, government welfare receipts, and transactional payments could be among the secondary responsibilities that the central bank digital currency (CBDC) plays in the future.

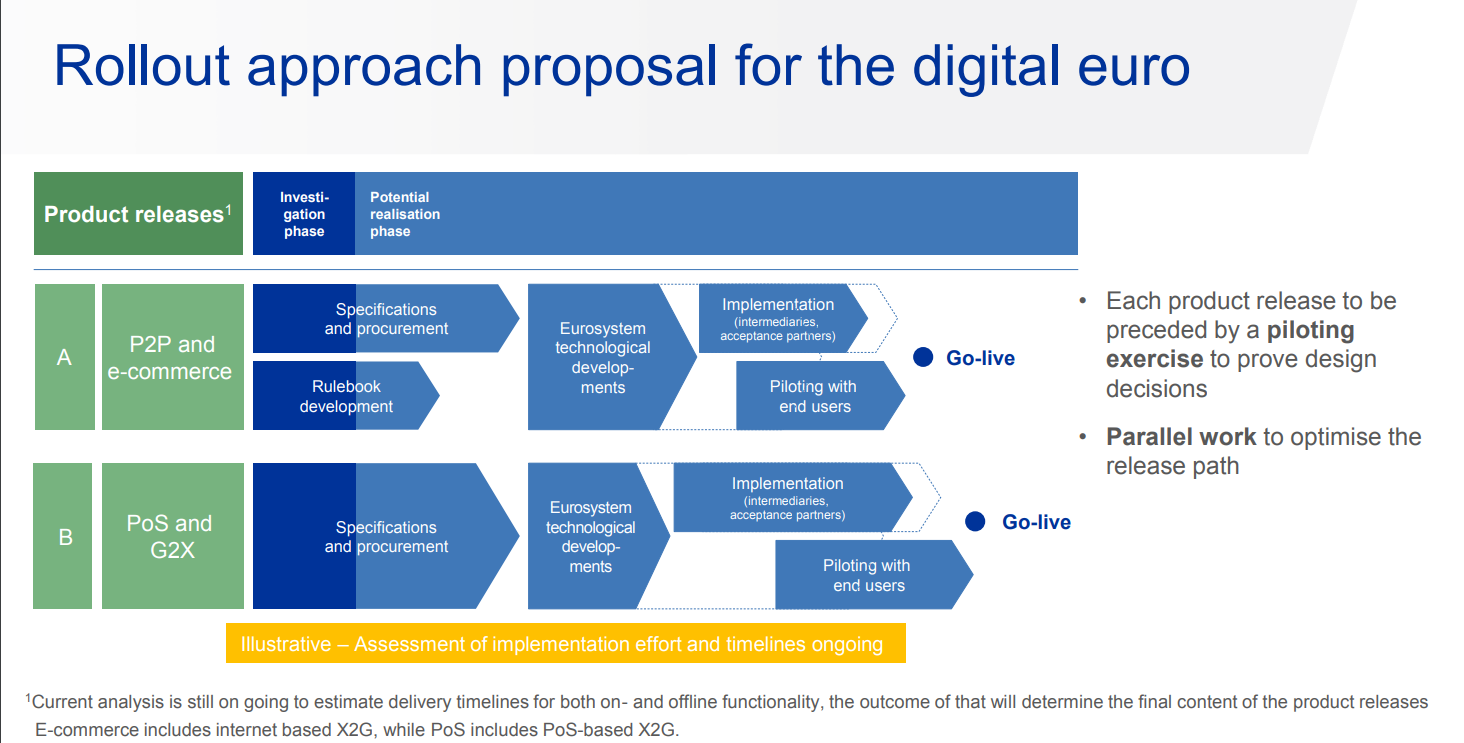

The European Central Bank (ECB) has published a document titled "Rollout Strategy for the Digital Euro," which offers an in-depth & informative look into the digital euro perspective.

A timeline of the CBDC's development is presented in the online publication, beginning with its genesis and ending with its anticipated deployment and use cases.

The statement comes to a close by expressing openness to receiving criticism regarding the digital euro initiative in the context of ongoing developments.

The digital euro team at the ECB believes that the CBDC needs to have many uses to satisfy users' requirements and fill voids in the market. In addition, the group stated that "in practical terms, a phased approach would assist in guaranteeing that end-users have a seamless payment experience."

In addition, the digital euro unit of the ECB noted that the approach described above might also lessen the complexity of the implementation. The unit suggests that certain activities like attempting to roll out or integrate new systems all at once, must become simpler.

Aspirations and Benefits of a Digital Euro

A recent online article emphasized the importance of using CBDC for e-commerce and making a payment among friends as the initial use case for cryptocurrency. Meanwhile, officials from the ECB believe that consideration of decentralized financing (DeFi) applications in conjunction with the digital euro should take place later.

In addition, the ECB had previously suggested that the digital euro should be free for private use. Yet, the major bank also mentioned that new rules might discourage banks from overcharging businesses and that these laws may be enacted in the future.

The European Central Bank is one of several global governments considering issuing a "centralized" digital currency. Even while the central bank of the European System does not anticipate its implementation soon, it has already begun to crystallize its strategy for a digital euro.

For instance, the European Central Bank (ECB) recently clarified that the digital euro would not replace fiat currency amid current technical evacuations. Instead, ECB executive board member Fabio Panetta put (2) it this way in a speech he gave to a committee of the European Parliament a month ago:

"Other forms of electronic payment, or even cash, would not be rendered obsolete by introducing the digital euro. Instead, it would act as a supplement to them. And by doing so, it would secure our monetary independence while also boosting Europe's strategic autonomy."

Panetta also cited the usage of the digital euro for making online payments as an ideal application for the currency. According to what he says (3):

"Our top aim for the Digital Euro project has always been very clear: to maintain the role of central bank money in the payment system by providing an additional choice for paying with public money, especially in settings where this is not currently available, such as in online shopping,"