Litecoin (LTC) was capitalizing on the bull run that it was experiencing at the time of the press release to develop a positive image. Some people would suggest that it was an attempt to take some of Bitcoin's (BTC) spotlight away from it. In a tweet sent out on January 21, LTC enumerated five qualities that distinguished it from other products on the market simultaneously and contributed to its overall attractiveness.

5 Things You Didn't Know About Litecoin⚡

— Litecoin (@litecoin) January 20, 2023

1) Litecoin was the fairest coin launch ever

2) The founder is still involved

3) Litecoin now has over 141 million transactions

4) You can use Litecoin almost anywhere

5) Litecoin is 4 Times Faster than Bitcoinhttps://t.co/0Ke3pgpBEd

Litecoin's emphasis on its speed, four times that of Bitcoin's, was a significant selling point. Even though such a remark can give the impression of being an attempt to make LTC look more desirable in comparison to Bitcoin, it only sometimes undercuts the competition.

Both cryptocurrencies have, in fact, successfully co-existed in the same market, demonstrating that none presents a danger to the other. The price of Litecoin has seen amazing gains thus far, but could investors consider it a better investment option for the current bull run?

Litecoin Showing Strength

When looking at the price behavior of Litecoin, it was discovered that at the time of writing, it had increased by around 125% since reaching its lowest 12-month level in June 2022.

On the other hand, compared to its lows in November 2022, Bitcoin had increased by 50%. The former has already been moving within a price pattern that is moving steadily upward. An extended move to the upside should, at the very least, put it above $100 when it reaches the next level of climbing resistance.

At the time of publication, there was room for the price to move before it met the climbing resistance line. Another observation suggested that the price would experience downward pressure from the selling activity. The previous record, which was hit on January 14, was surpassed within the last 24 hours by the new nine-month high that was achieved.

Meanwhile, there has been some slippage in both the RSI and the MFI, which indicates that the trend is weakening. This discovery uncovered a price-RSI divergence, frequently indicative of a forthcoming negative move.

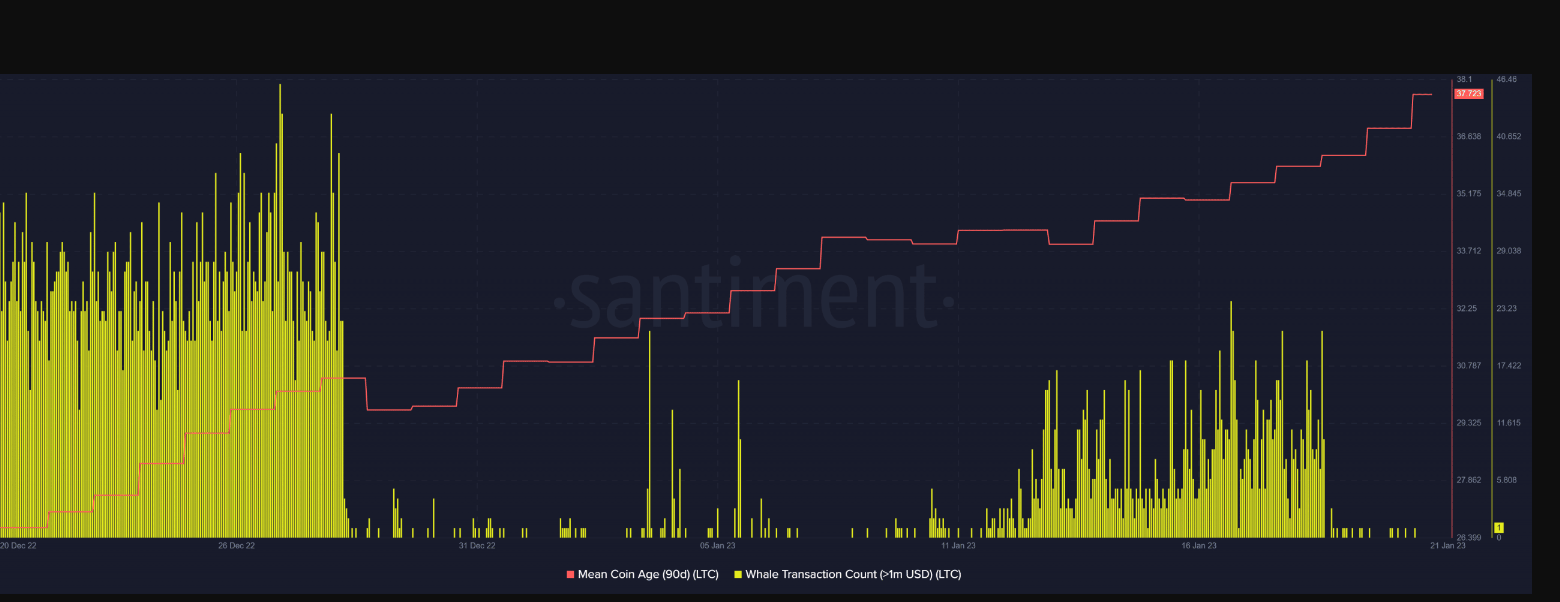

The distribution of LTC's supplies revealed that several of the biggest and most dominating whales had already been purchased since this article was written.

Currently, addresses that possess between 100,000 and just one million coins control the most significant proportion of the available supply of Litecoin. Since three days ago, the same address group has contributed to the increasing pressure to sell.

Despite this, there is still a low amount of whale transactions, which is confirmation that there is limited sell pressure for the time being. The average coin age measure has also maintained its upward trend, which suggests that investors are continuing to hang on to their Litecoin coins.

The last time Litecoin saw a price-to-RSI divergence, the market experienced a pullback in the days that followed, and it may take place once more during the following several days. Even though conditions indicate that the market is overbought, investors must remember that the market forces now favor the bulls.