Mining Bitcoin is now more difficult than ever before. This weekend will mark the first time Bitcoin's mining difficulty will surpass the 40 trillion threshold. However, the data from the blockchain indicate that the mining difficulty will decrease by an estimated 29.66%, going from 43.05 to 30.28 in the next 20 days.

The mining difficulty is an expression of the number of iterations miners must complete obtaining the hash of a Bitcoin block. Because of this, as the number increases, it will become increasingly more challenging to solve a block, resulting in decreased profitability for mining.

This measure is updated once every two weeks, and a rise in difficulty can be attributed to adding additional miners to the Bitcoin network. As a result of the increased mining difficulty, miners should expect a reduction in Bitcoin production over the next 12 days, which will amount to around 2,016 blocks.

Because of the recent uptick in the value of Bitcoin, the complexity of Mining bitcoin has been progressively increasing over the past few months. On January 16, 2023, at the time of the previous all-time difficulty, the Bitcoin network reached an all-time high of 39.35 trillion. However, it then witnessed a 0.49% decrease.

At that time, the difficulty level remained consistent, around 39 trillion. Bitcoin's hash rate considerably increased during this period, culminating at an all-time high on February 16, 2023.

The Price Spike Has Encouraged Mining Activity

Due to the prolonged bad market that bitcoin (BTC) experienced in 2022, many miners operating on the network experienced negative financial outcomes. Some miners were forced to diversify their businesses to continue mining, while others gave up mining altogether and sold their equipment. This, of course, decreased the difficulty of mining bitcoin and the hash rate.

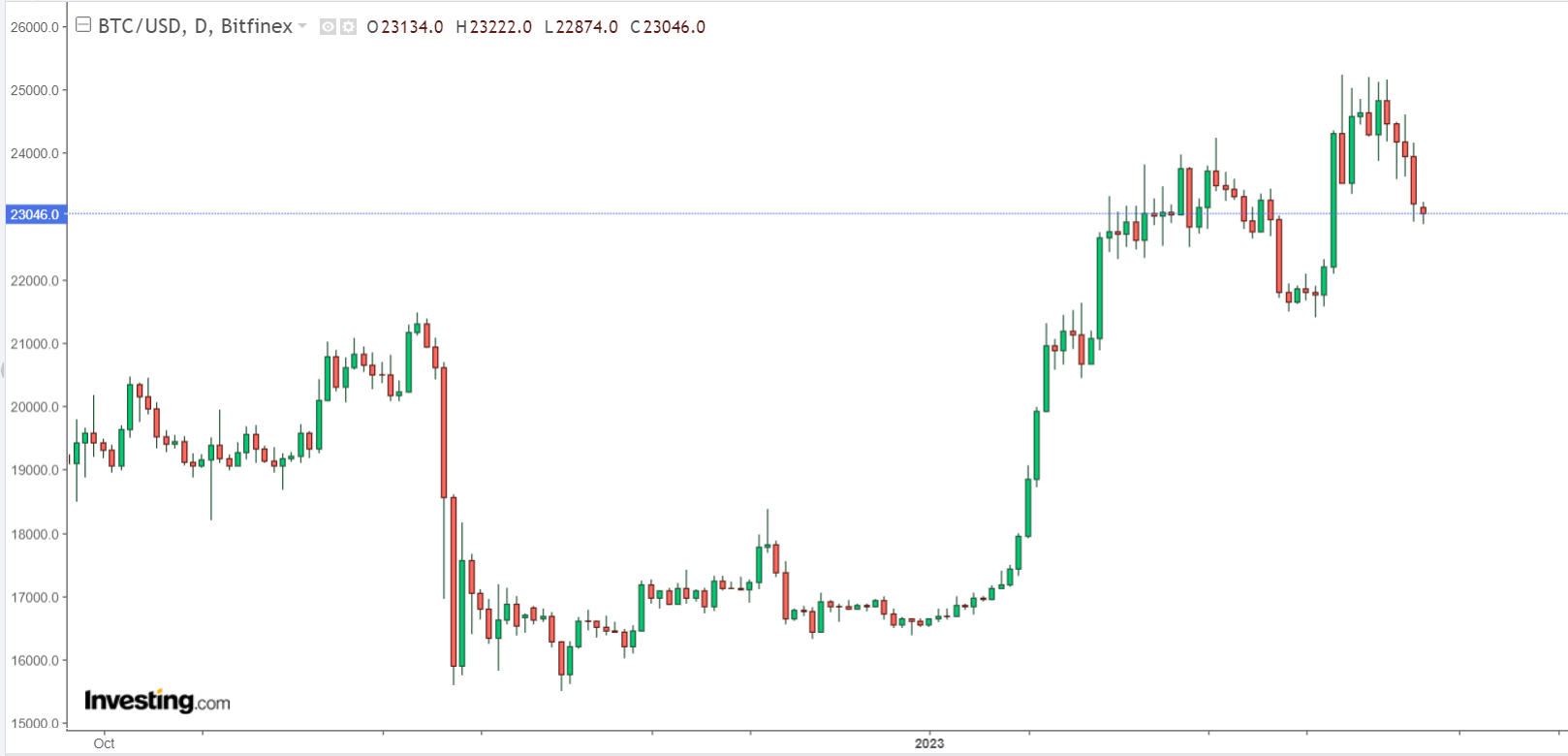

On the other hand, things are different now in the year 2023. To begin, the price of one Bitcoin on the market had climbed by more than forty percent since it hit its all-time low in November 2022 ($15,670), when it stood at that price. Because of this, miners who are interested in capitalizing on the trend are paying attention to it.

Second, increased activity can be attributed to the proliferation of non-fungible tokens (NFTs) known as Ordinals on the Bitcoin network. Mining costs have recovered to more desirable levels as a direct result of the greater transactions that these NFTs entail.

However, because Ordinals transactions are more substantial than "normal" ones, the incurred fees are typically more than $20. Naturally, this is dependent on the magnitude of the transaction as well as the priority that has been given to it.

According to data provided by Dune analytics, miners have raked in more than $800,000 in fees from Ordinal NFTs in under a month.

The creation of Ordinal NFTs has been controversial since some believe it contributes to congestion on the Bitcoin blockchain, leading to increased transaction costs. Despite this, these variables have increased competition among miners, making mining more challenging.

Bitcoin Price

As of when this article was written, the current market price of bitcoin is $23,046.