Since the beginning of 2023, the United States Securities and Exchange Commission (SEC) has been increasing the pressure it exerts on the cryptocurrency market, as is common knowledge. The SEC's most recent and significant action is terminating the crypto staking service offered by the cryptocurrency exchange Kraken.

The SEC's Crackdown

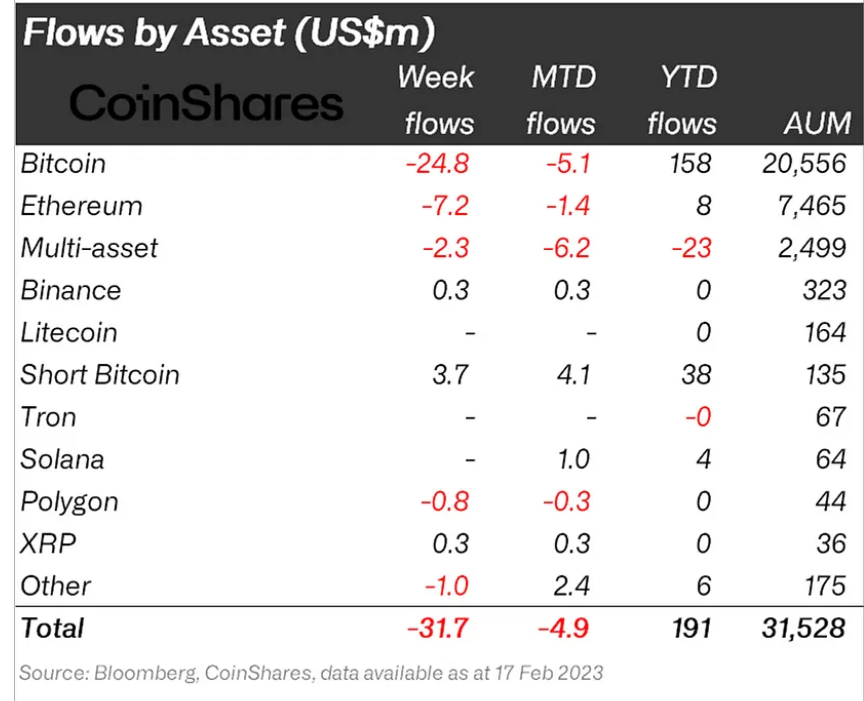

According to the most recent research from CoinShares, institutional investors in the United States have been avoiding further involvement in the cryptocurrency market as a result of the legislative crackdown that is now taking place in the country. The virtual currency investment vehicles experienced the highest weekly outflows in 2023 up until this point during the previous week.

According to the study (1) of CoinShares, investment products related to digital assets saw a net outflow of $32 million during the previous week. According to the official report:

"Digital asset investment products experienced total outflows of US$32 million last week, the biggest amount seen since late December 2022," The outflows were significantly greater at 62 million US dollars midway through the previous week, but by Friday, the mood had improved.

These outflows occur when the SEC has been conducting a significant crackdown on the cryptocurrency market over the past several weeks. The SEC has been going after many organizations operating in the cryptocurrency industry, such as those involved in crypto staking, custody, and stablecoins.

Significant Bitcoin Linked Products Withdrawals

CoinShares observed in its analysis that most outflows were in products related to Bitcoin. Bitcoin-related financial products are responsible for a whopping 78% of the overall outflows of capital. Conversely, Bitcoin short funds received an infusion of $3.7 million over this period.

The head of research for CoinShares, James Butterfield, observed: "We believe this is due to ETP investors being less positive on recent regulatory concerns in the US relative to the broader market."

The negative sentiment held by institutions regarding alternative cryptocurrencies remains mixed. Outflows of funds totaling US$7.2 million, US$1.6 million, US$0.8 million, and US$0.5 million were recorded for Ethereum, Cosmos, Polygon, and Avalanche, respectively.

On the other hand, transactions ranging from $0.36 million to $0.26 million came into Aave, Fantom, XRP, and Decentraland, respectively.

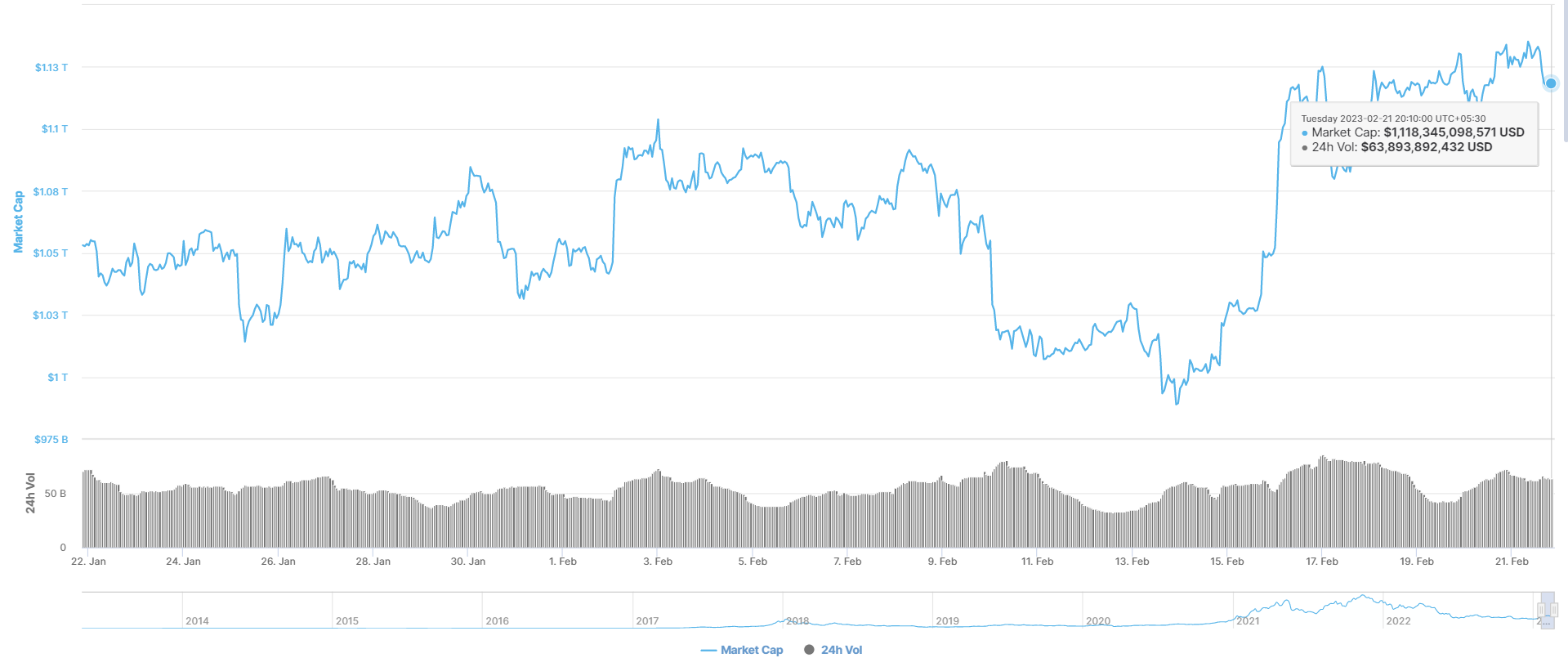

Last week, the cryptocurrency market experienced a remarkable bounce, with Bitcoin (BTC) rising to $25,000. This occurred even though institutional confidence in cryptocurrencies is declining due to actions taken by the SEC.

The total value of all cryptocurrencies on the market has increased by over $100 billion and now surpassed $1.18 trillion. Last week, Bitcoin and several alternative cryptocurrencies had very strong performances, which helped to ease some of the market's anxieties.