More and more people are investing in Bitcoin [BTC] alongside conventional stock markets. The price of Bitcoin [BTC] has been rising since the beginning of the year after dropping for several months. Despite the large gain, it has yet to return to the $60,000 level.

The price of Bitcoin has been associated with traditional assets, especially during the Covid-19 outbreak. What does the current state of the BTC correlation score indicate for cryptocurrency investments?

The Bitcoin Correlation Score

The correlation score can be used to evaluate the degree to which Bitcoin's price and another asset's or basket of assets' values move in tandem.

We examine the historical price movements of Bitcoin and other assets to see how closely they have mirrored one another to establish the degree of correlation.

If the correlation score is -1, then there is no relationship between the values of the two assets; if it's 0, then there is no relationship between the prices of the two assets; and if it's 1, then there is a perfect correlation.

Investors can use the correlation score as a tool to assist them in spreading out their money across a wider range of assets. Diversifying your investments among asset classes with low correlation might help you spread your money and reduce your exposure to any particular risk.

One thing to remember is that correlation scores change over time. That's why it's crucial to keep tabs on your assets' correlations and make any adjustments to your investment strategy as needed.

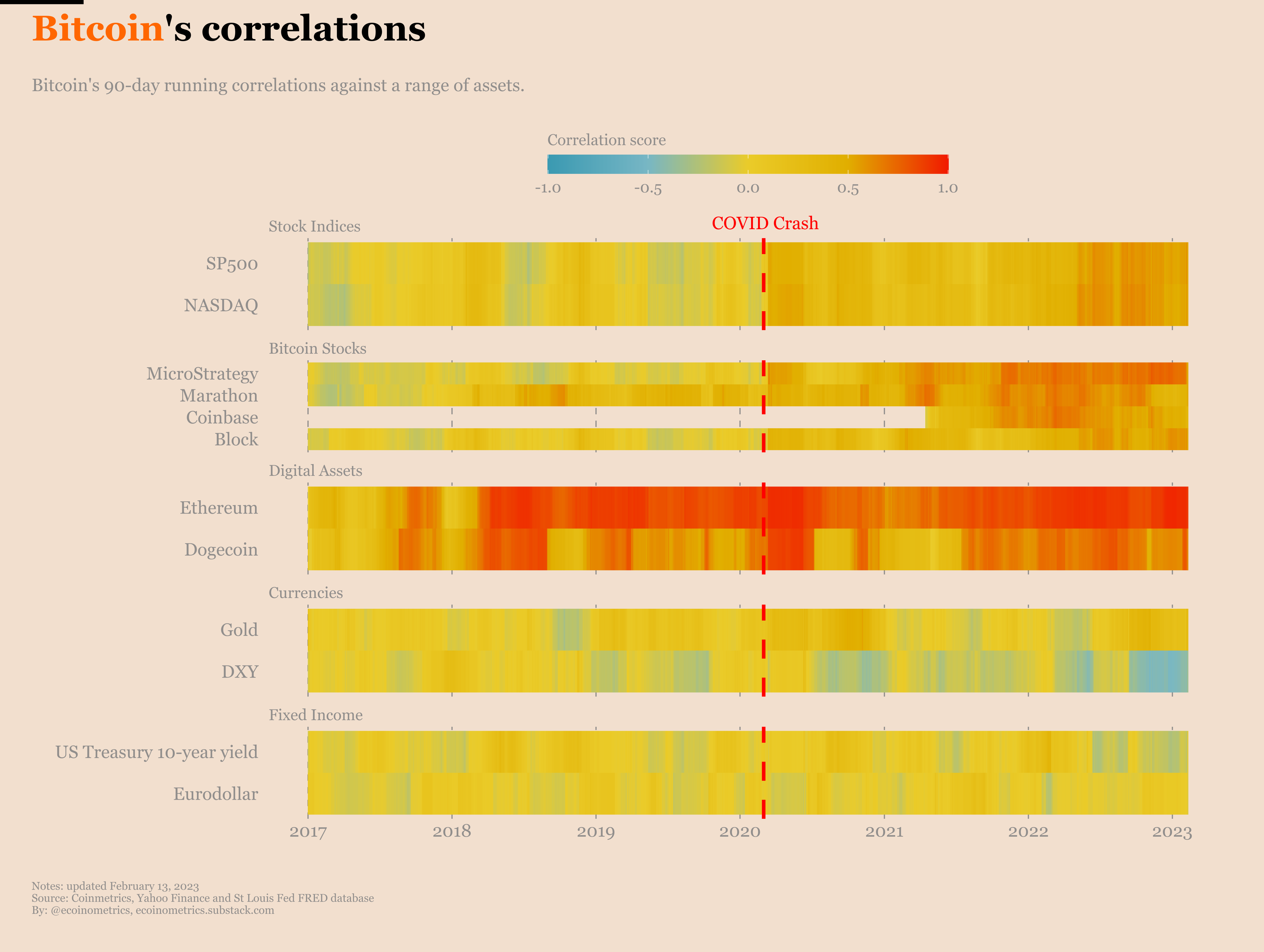

According to econometric research (1), Bitcoin's correlation score shifted considerably after the Covid-19 pandemic. This research aimed to use the newly accessible correlation score to obtain a sense of certain types of investments.

Bitcoin's correlation with other markets was studied by selecting the S&P 500, the NASDAQ, Bitcoin stocks like MicroStrategy, Marathon, Coinbase, and Block, the U.S. Dollar Index (DXY), and Eurodollar futures. Interestingly, the link between Ethereum and Dogecoin was also investigated.

Before March 2020 (pre-Covid), there was little correlation between Bitcoin and the stock market indices. Then, an orange gradient emerges, suggesting a connection.

It should be no surprise that Bitcoin has a solid connection to other digital currencies. Despite historical fluctuations into and out of correlation zones, the Bitcoin price and the gold price have been closely connected as of late.

Yet, there has been zero pre- or post-epidemic link between the DXY and Euro futures. Correlation is shown in deep red, anti-correlation in deep blue, and no correlation in yellow.

Changes in Bitcoin's Value

At the time of writing, the SP500, Nasdaq, and Bitcoin Index were all trending differently.

Losses on the SP 500 and Nasdaq were less than 1%, gains on the Bitcoin Index were over 1%, and the index flashed green. Nonetheless, the DXY and Euro futures were also showing bullish signals.

When we look at the daily chart of Bitcoin's price activity, we can see that it is increasing. A relative Strength Index line above 70 indicates a bullish trend.

At the time of writing, the price of a single Bitcoin was slightly over $24,660. Also, it indicated a rise of over 4.8% in the last 24 hours.