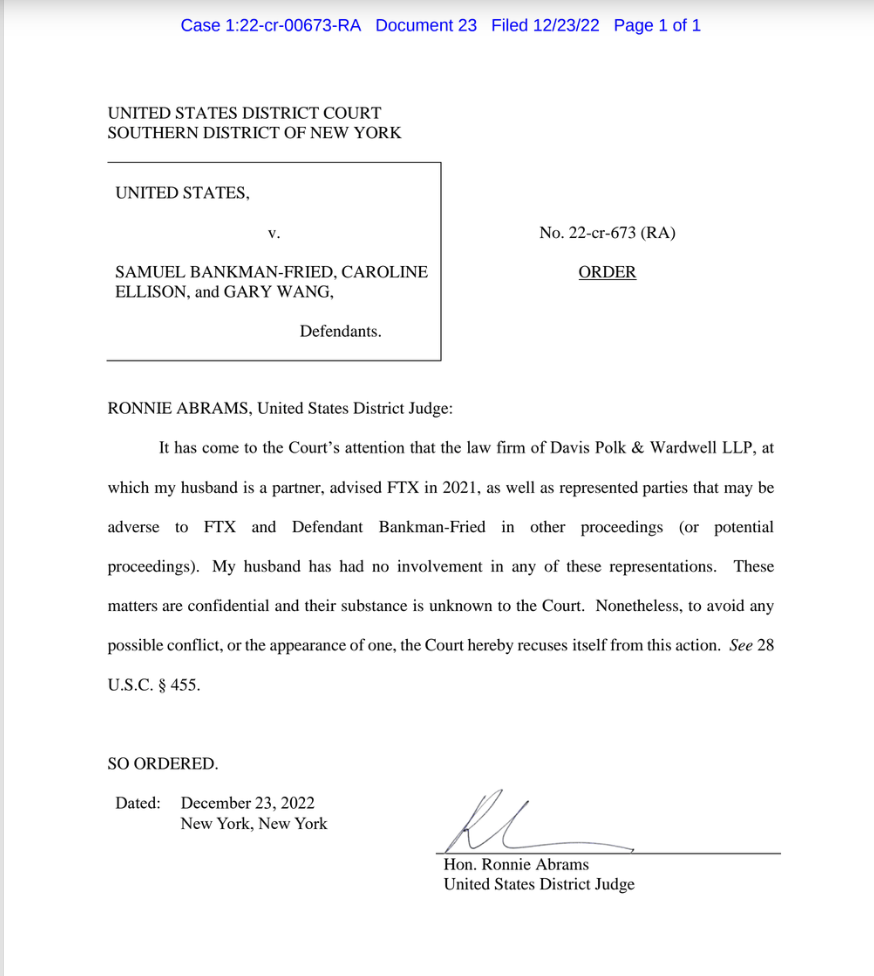

As a result of District Judge Ronnie Abrams' decision to withdraw her participation in the case, the ongoing legal processes concerning the former CEO of FTX, Sam Bankman-Fried (SBF), took an unexpected new turn.

The US District Court based at Southern District of New York could extricate itself from the FTX case once it became public knowledge that a law firm had guided the cryptocurrency exchange in 2021. The law company in question is one in which Abrams' husband is a partner.

Judge Abrams disclosed (1) on December 23 that her spouse, Greg Andres, is a partner at Davis Polk & Wardwell, a legal firm in which he has been engaged since June 2019.

The disclosure was made in a document that was filed on December 23. In addition, it was brought to everyone's attention that the legal firm had provided FTX with advice in 2021.

Abrams also mentioned that the law firm had represented parties in prior court procedures that were potentially in opposition to FTX and SBF. She elaborated by saying, "My husband has had no involvement in any of these representations," while simultaneously adding that the matters are unknown to the District Court due to the secrecy of the information.

"However, in order to steer clear of any potential conflict, or even the impression of one, the Court hereby absolves itself of responsibility for this action."

Because Andres continues to function as a partner at Davis Polk & Wardwell law firm, the potential for a conflict of interest in the FTX case has been eliminated due to Judge Abrams' decision to recuse herself from the matter.

Details of Andres's Previous Assignment

Andres had held the position of Assistant Attorney for the Eastern District of New York. During that time, he was notably responsible for supervising criminal fraud cases and investigations into overseas bribery.

SBF was released from custody on a bail bond of 250 million dollars on December 22, based on a written pledge to present for future court appearances and refrain from engaging in unlawful activities.

However, some questions were raised about the bail, given that SBF had previously stated that it had less than $100,000 in assets during the bankruptcy filing process.

One User Said on Twitter: "Funny how SBF is able to post the $250M bail not long after saying he only had $100k. So he probably is using stolen customer deposits to stay out of jail."

Funny how SBF is able to post the $250M bail not long after saying he only had $100k.

— Benjamin Cowen (@intocryptoverse) December 22, 2022

So he probably is using stolen customer deposits to stay out of jail.

Another user said:

"Concerning how rife Twitter is with misinfo due to a lack of critically analyzing contents of a story. While $25MM isn’t trivial, it’s the amount put up as collateral given posting bail requires 10% of the bail amount. Need critical thinking from the masses, not better algos"

Bankman-Fried could walk free from jail thanks to the personal recognizance bail, which did not require him to make any payment. The bond was granted in exchange for a property jointly owned by the defendant's parents, a relative, and a family friend.