U.S. federal prosecutors filed filings in Manhattan on Friday seeking (1) approval to use a website to contact victims of the FTX collapse. It was granted on the same day by U.S. District Judge Lewis Kaplan, who presides over the case.

More than 100,000 debtors were included in FTX's bankruptcy petition (2) on November 11, but these do not include customers of FTX or FTX US, its crypto currency exchanges. When users are factored in, the total rises to 1 million. The prosecution claimed it would be "impractical" to try to get in touch with each defendant.

Prosecutors must inform victims of upcoming plea or sentence hearings and offer them an opportunity to testify in criminal cases.

The court will decide how victims will be heard at such procedures "based on the number of victims who provide such notice," Kaplan stated in his court decision.

During a hearing in December before the U.S. House Financial Services Committee, John Ray, the current CEO of FTX and overseer of its Chapter 11 restructuring, said that a very limited number of US customers were impacted by FTX.

"We do know that there were 2.7 million users in the U.S. silo, which again is overstating the customer relationships because people had multiple trading accounts," Ray testified.

"Again, the number of accounts held by a single client causes this figure to be higher than the true number of customers served by [FTX.com]. Consequently, we must investigate the source of these low consumer counts. Not many of them will be able to make it to court in Manhattan, though."

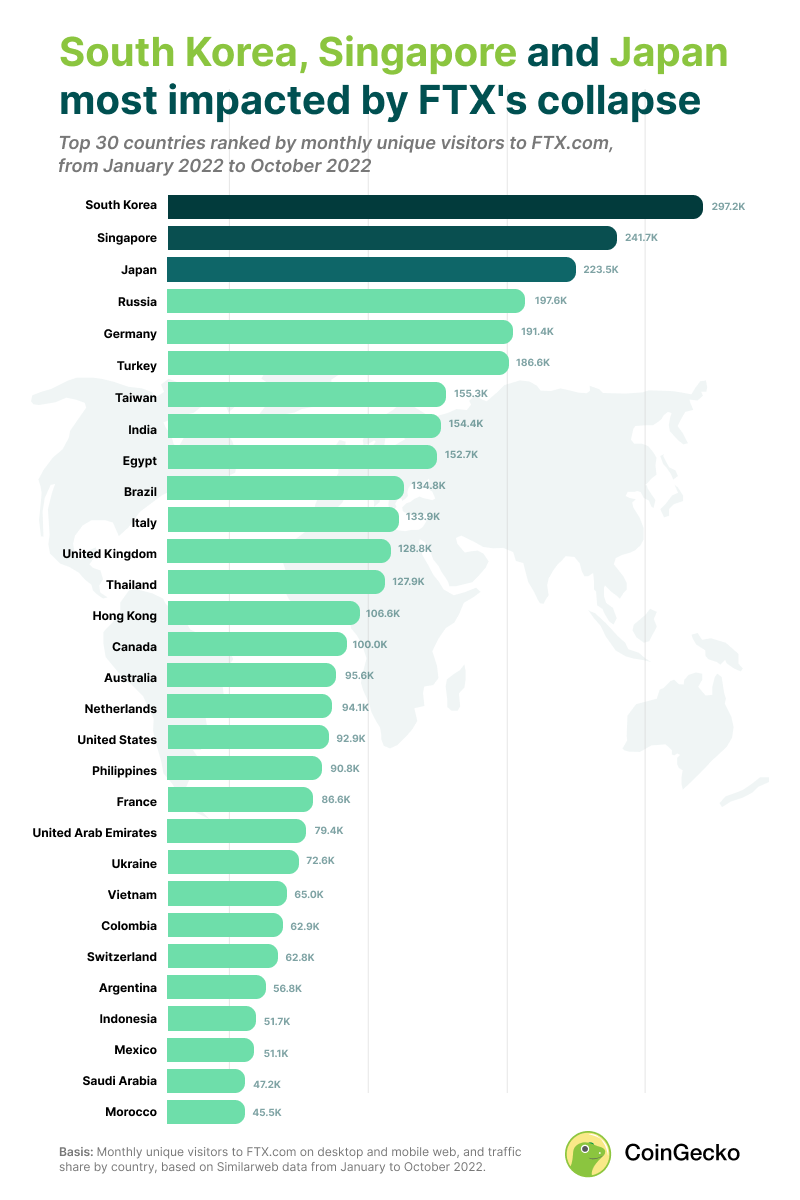

Details of FTX's Users Spread Globally

It is estimated that 16% of FTX.com's pre-closure traffic came from South Korea, Singapore, and Japan, according to data (3) compiled by CoinGecko from analyses of the website's monthly active users. There was a 2% share of traffic from the United States, despite the site being set up to seamlessly detect if a visitor was in the U.S. and send them to FTX US, the company's U.S.-based business.

It should be noted that the criminal prosecution brought against FTX founder Sam Bankman-Fried has nothing to do with the bankruptcy procedures that have been ongoing in Delaware since last November.

Along with Bankman-Fried, federal prosecutors also brought charges against ex-Alameda Research CEO Caroline Ellison & FTX co-founder Gary Wang, who have already pled guilty and have been cooperating with authorities.

There have been indicators of growing impatience among FTX's millions of lenders and users as the bankruptcy case continues.

This week, the Venable law firm representing the Committee of Creditors of FTX Trading objected to FTX's request for additional time to produce a detailed inventory of FTX's assets and obligations.

On November 17, FTX applied for a deadline extension that would push the original due date to January 23. FTX resubmitted paperwork on December 21, requesting a deadline extension until April 15.

The special committee, however, is not certain that the additional time will prove useful.

Attorney Daniel O'Brien said in the objection,

"it does not appear that the Debtors will ever be able to reconcile their pre-petition books and records (or, more likely, create them in the first instance) and file accurate schedules and statements in these Chapter 11 cases." Under the current conditions, there is no justification for a deadline extension.

Since FTX "likely never be able to file accurate Schedules and Statements under the circumstances," O'Brien speculated that a similar method would be useful in the company's bankruptcy procedures.