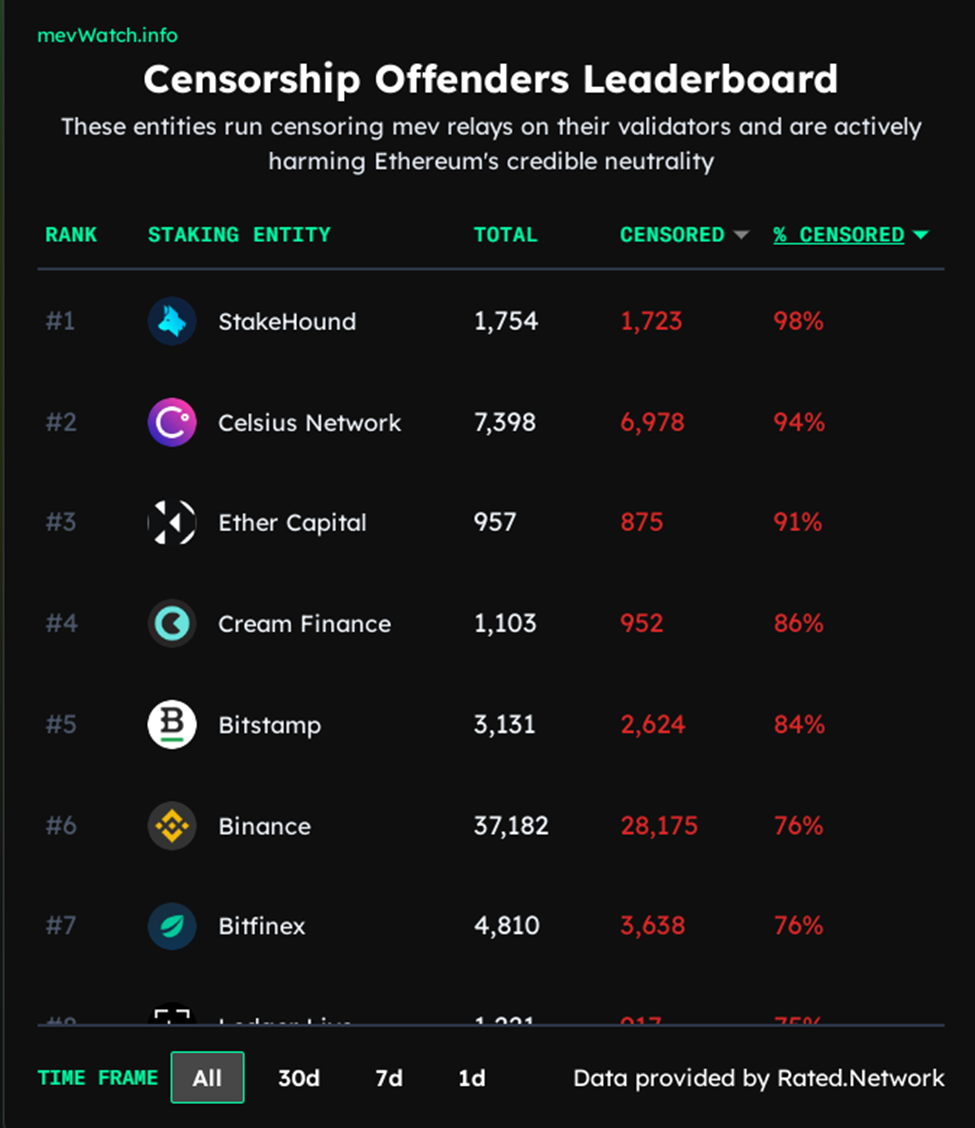

The staking of ETH on major exchanges contributes to the censorship of Ethereum. The usage of filtering MEV relays by crypto currency ecosystems and exchanges is one of the most significant aspects that undermine the neutrality and credibility of Ethereum.

Complying with government sanctions has a detrimental effect on the worldwide spread of the vast majority of crypto currency ecosystems. When it pertains to Ethereum, however, investors hold a large amount of authority, which allows them to define the level of compliance obeyed by the ecosystem.

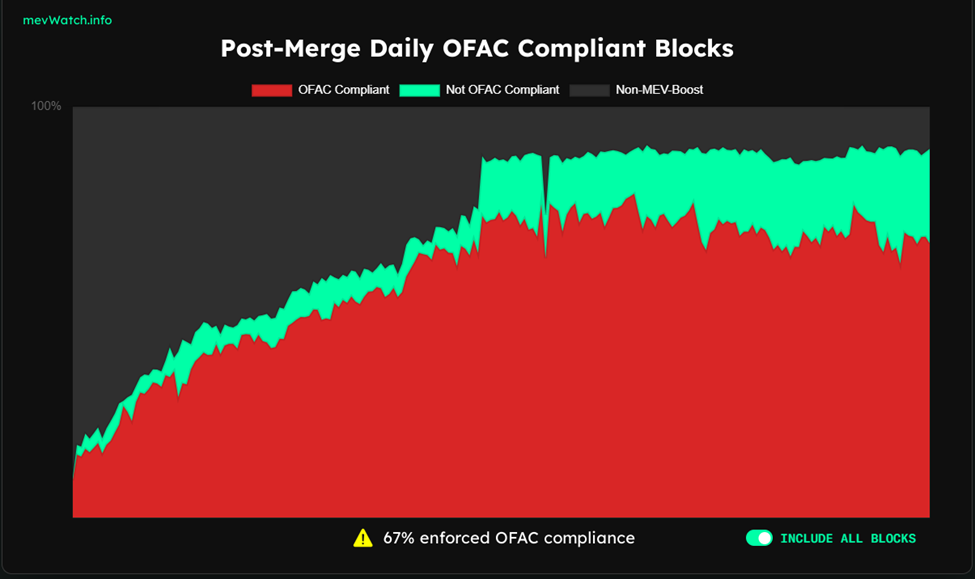

A little under 67 % of all Ethereum blocks created after the merge comply (1) with the penalties imposed by the Office of Foreign Assets Control of the United States (OFAC).

Despite the fact that the crypto currency community is united in its opposition to this change, many participants are unaware of their role in bringing Ethereum closer to full OFAC compliance.

The usage of filtering MEV relays by crypto currency ecosystems and exchanges is one of the most significant aspects that undermine the neutrality and credibility of Ethereum.

What Can Be Done to Remedy the Situation?

Miner extractable value (2) (MEV) relays operate as a middleman between block producers and builders. These relays are employed by key crypto currency companies such as Binance, Celsius Network, Coinbase, Kraken, and Cream Finance, to name just a few.

Directly contributing to the censorship of Ethereum are users who stake Ether on platforms (such as those indicated above) that run censoring MEV relays on their validators. By implementing a non-censoring MEV-boost relay, crypto platforms can contribute to the effort to rectify the situation.

Ultra Sound Money, Agnostic Boost, Aestus, BloXroute Max Profit, BloxRoute Ethical, Manifold, and Relayooor are some of the prominent MEV-boost relays that do not support censorship and are available to validators and relay operators.

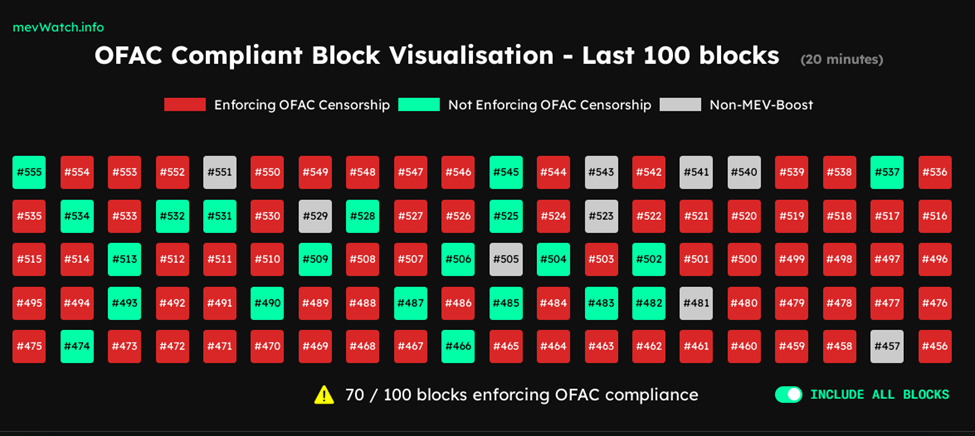

When this article was written, 70 of the most recent 100 blocks of Ethereum were verified to conform with OFAC.

Investors need to have a solid understanding that censorship at the protocol level is a barrier to the realization of the crypto currency industry's vision of democratizing the financial system. Therefore, investors and service providers need to go with non-censoring MEV-boost relays.

The ecosystem surrounding Ethereum recently witnessed the reawakening of two dormant addresses after four years, resulting in the transfer of 22,982 ETH.

#PeckShieldAlert 2 Dormant addresses transferred 22,982 $ETH (~27.2M) to 2 fresh addresses, their last movement was October 2018 (1,535 days ago).

— PeckShieldAlert (@PeckShieldAlert) December 19, 2022

These $ETH originated from Genesis and Poloniex pic.twitter.com/MXKpLnypif

The ETH transactions in issue may be tracked back to the trading platforms Genesis and Poloniex, where the unidentified whales transferred a total of 13,103.99 ETH and 9,878 ETH, correspondingly.

Technicals of Ethereum

At the time of writing, the top altcoin was trading at $1,219. It has been oscilating between the high of $1,360 and low of $ 1,080 since last 3 months. Shortly, it broke out in October but again it is back in the range. We can expect any positive up move only if it breaks the upper box level of $ 1,360.