A prolonged bad market has prompted concerns about the general health of the Bitcoin mining sector. Recently, Bitcoin miner Core Scientific filed for bankruptcy, despite a $72 million rescue offer from creditors.

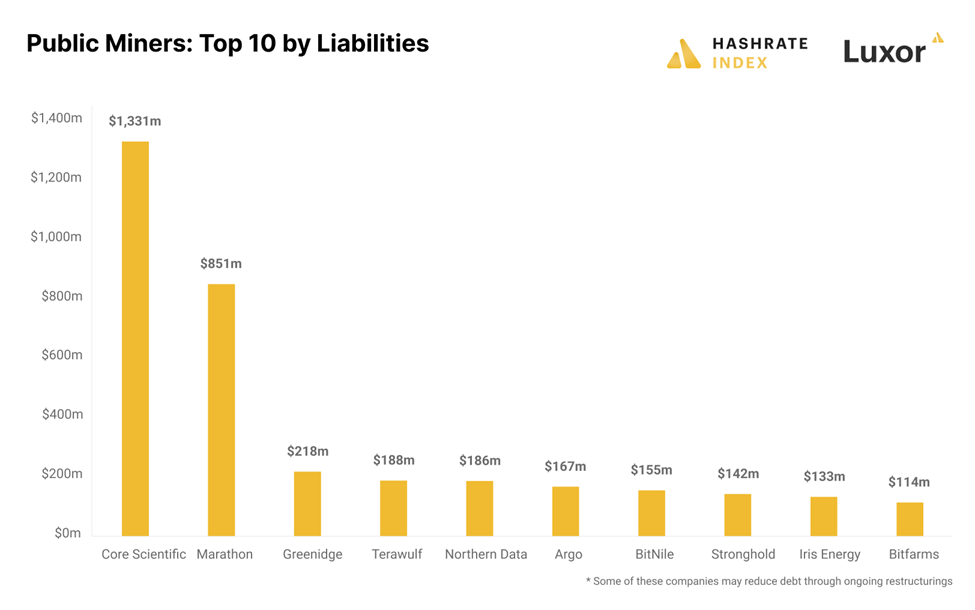

It has come to light that the publicly traded Bitcoin miners are responsible for obligations totaling more than $4 billion and require an urgent restructuring to escape the unmanageably high debt levels.

The Bitcoin mining world took out enormous debts during the bull market in 2021, severely influencing their bottom lines during the next bear market. Hashrate Index's analysis of data relating to Bitcoin mining reveals (1) that the top 10 Bitcoin miners collectively owe more than $2.6 billion in debt.

Core Scientific, the company with the largest liabilities on its balance sheet as of September 30 ($ 1.3 billion), has recently filed for Chapter 11 bankruptcy shelter in Texas due to decreased revenue and falling BTC prices.

The second largest debtor, Marathon, has liabilities of $851 million, most of which are in the form of convertible notes. Consequently, Marathon can avoid going bankrupt since it permits its debt holders to convert convertible bonds into stocks.

Several Bitcoin Mining Companies in Process of Restructuring

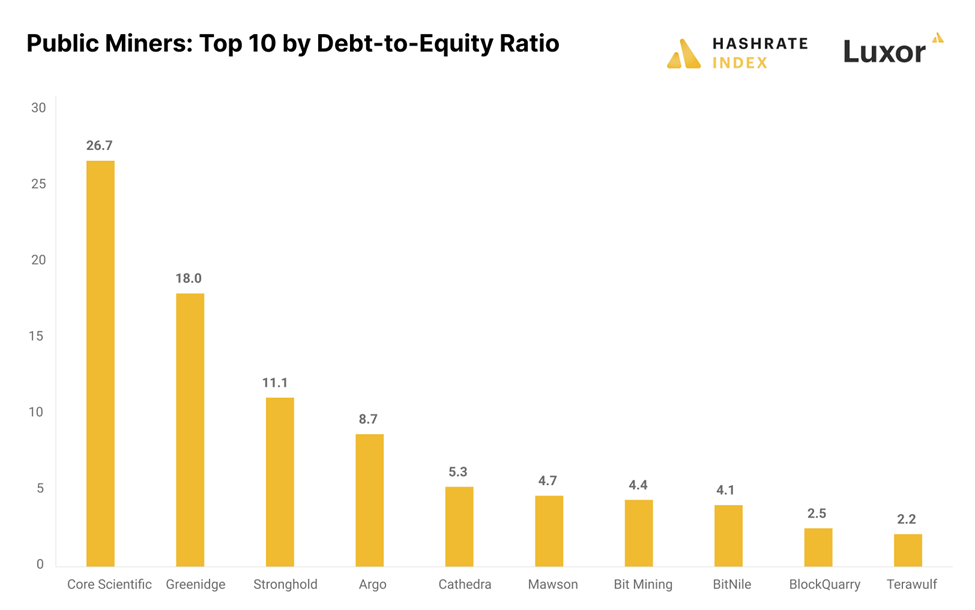

Most Bitcoin miners, including Greenidge, the third-biggest debtor, are in the process of restructuring to lower their amount of outstanding debt. The ratio of debt to equity held by publicly traded Bitcoin mining companies indicates a high level of risk for the industry as a whole.

According to the findings of the Hashrate Index, a debt-to-equity ratio of 2 or more is seen as dangerous in the vast majority of business sectors. The graph below illustrates how some of the most notable Bitcoin miners currently flaunt exceptionally high debt-to-equity ratios.

Because far more than half of the 25 publicly traded bitcoin miners have extraordinarily high debt-to-equity ratios, the mining industry may experience probable reorganizations & bankruptcy filings until the bulls return.

Bearish Bitcoin Continues to Harm Miners Well-beings

Sustainable miners will be capable of expanding their presence as a result of this since they will be able to purchase the equipment and facilities of their competitors. This may cause some businesses to halt or slow down activities to limit liabilities.

Greenidge signed an agreement to restructure its $74 million debt with the NYDIG on December 20. NYDIG is a fintech company that is committed to Bitcoin.

The terms of the NYDIG agreement would call for the acquisition of miners with a mining capability of around 2.8 exahashes per second (EH/s). As a result of the trade-off, the mining company's total debt would decrease by $57 million to $68 million.

As of writing this article, Bitcoin was trading at $ 16,840, down 8% from last weeks high level of $18,387.