Following its most recent quarterly financial results, Tether (USDT), the leading stablecoin issuer in the world, may at long last have reason to celebrate.

According to the announcement (1) made on Thursday, Tether made a "net profit" of seven hundred million dollars during the third and final quarter of 2022.

Interestingly, this will be the first time the company has publicly acknowledged its profit. In addition, the issuer has said that the funds would increase the company's reserves.

USDT Taking Step to Put All Doubts About Reserves to Rest

It is important to note that Tether has, for a considerable amount of time, been plagued by fears that its tokens might not be backed one-to-one by an amount equivalent to reserves.

Consequently, the fact that they have added their gains to their reserves is not remarkable in and of itself. Paolo Ardoino, who serves as Tether's chief technical officer, believes it is more of a demonstration of stability. In part of his essay, Ardoino wrote:

"Tether has once again demonstrated its stability, robustness, and capacity to withstand downturn markets and black swan occurrences, establishing itself apart from the negative actors of the sector"

Tether is delivering on its pledge to lead the industry in openness by presenting this most recent consolidated reserve report. This is part of Tether's ongoing commitment to fulfilling this promise.

Ardoino also said that they are pleased with how Tether has maintained a leading role in restoring confidence in the crypto currency sector, and we are resolved to continue to serve as a good model for our colleagues and our rivals.

Meanwhile, concerns over Tether's reserves were initially voiced in May last year. At that same time, the USDT stablecoin suddenly parted ways with its link to the dollar. Tether swiftly reacted, noting that its capacity to repay cash to holders is unaffected, even though the fall of terraUSD was the root of the issue.

Additionally, holders continued to express skepticism regarding Tether's previous choice of reserves. At one point, a significant portion of the company's assets was held in commercial paper, a type of unprotected, short-term corporate debt.

Because of this, many investors were concerned that big withdrawals might put the company in a precarious position regarding its liquidity.

In response to these concerns, Tether said once more that it had totally withdrawn its commercial paper assets from its income statement and replaced them with US Treasury notes.

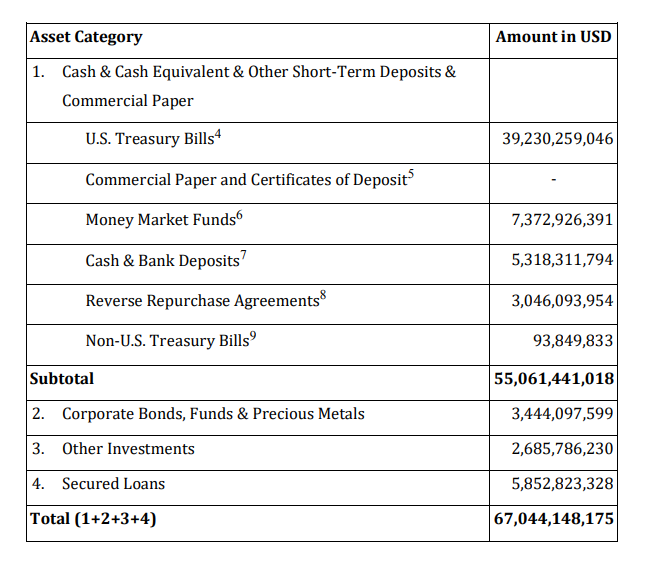

According to the report released Thursday, the company reveals that Treasury bills now comprise more than 58% of its total assets. In addition, the company's liabilities of $66 billion are now lesser than its assets, valued at around $67 billion.

Despite this, USDT and the organization that issues it continues to be contentious in the crypto currency market. Additionally, there are claims that the Department of Justice in the United States is aggressively investigating leaders at Tether for suspected violations of bank fraud laws.