Tether does not consider this a danger, even though some customers may be moving their attention to the company's rival.

It would appear that the Circle-issued USDC stablecoin has suddenly found itself to be a favored option among users of crypto currencies due to a series of events that took place in the year 2022.

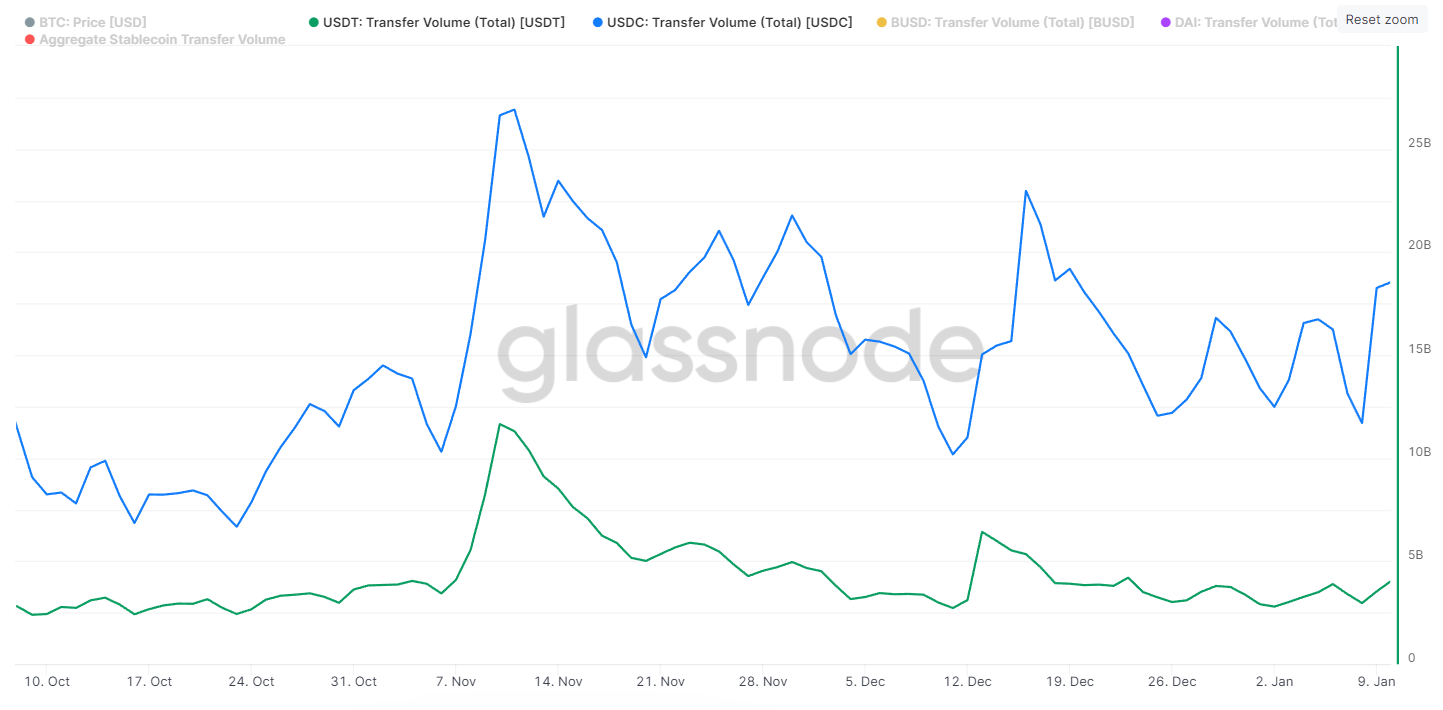

The USDC now witnesses a daily transaction quantity up to four or five times that of its primary competitor, the USDT, according to a data study published by the blockchain analytics firm Glassnode.

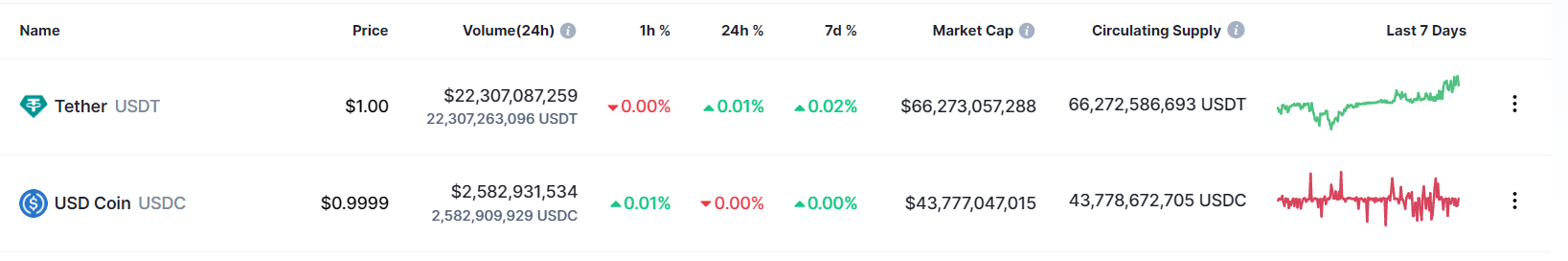

This is although USDT continues to hold the position of being the largest stablecoin based on market capitalization.

The market cap of USDT is $ 66 Billion, where as USDC has its market cap value at $ 43.77 Billion as per the data from coinmarketcap web site.

According to the available information, the transfer volume of USDC is $15 billion, whereas the volume of USDT is only $3 billion. The overall volume of transfers conducted by USDC is seven trillion dollars greater than that of USDT.

What is Driving the USDC Growth Story?

It is possible that it is crucial to note that stablecoins are typically the easiest choice for crypto currency investors, especially at a time like today when market volatility is at its highest level and has been for some time.

Despite this, USDC appears to be receiving most of the focus these days. Therefore, the fact that speculators consider USDC a safer option explains everything that has happened up to this point.

Many USDC fans always point out that either actual cash or short-term U.S. treasuries back USDC's assets. They also discuss how Circle guarantees that monthly audits are carried out and is typically honest with the overall process.

When it comes to its reserves, Tether, in contrast extreme, has been accused on multiple occasions of being dishonest and telling only part of the truth.

In October 2021, the firm responsible for USDT was hit with a punishment of $41 million. At that point, the Commodity Futures Trading Commission CFTC criticized it for failing to retain sufficient reserves for approximately 72 percent of the previous two years.

In addition, some investors were concerned that USDT was exposed to FTX and Alameda. Around this time, it momentarily unpegged itself from the U.S. dollar immediately after the FTX exchange failed. On the other hand, Tether has dispelled the concerns by stating that there is no such vulnerability in their network.

Tether does not consider this a danger, even though some of its customers may be moving their attention to the company's rival. The company insists (1) that this demonstrates "the market's continued trust and confidence in Tether" and points to the fact that its market value has been growing consistently as evidence.

Tether’s $USDt market cap hits $64B! 🎉

— Tether (@Tether_to) August 16, 2021

A new milestone reached and another indication of the market’s continued trust and confidence in #Tether ! pic.twitter.com/t85i6e6UQt

"Tether’s $USDt market cap hits $64B! 🎉A new milestone reached and another indication of the market’s continued trust and confidence in #Tether !"