The token concept for the native asset SUSHI may undergo a complete rethinking in the case of SushiSwap (SUSHI), which will be an essential decentralized protocol ever since the DeFi Summers of 2020.

The Chief Executive Officer of SushiSwap, Jared Grey, explains (1) the ins and outs of his idea. New rules for holders of SushiSwap LPs and xSushis stipulate longer locks and more generous incentives.

According to the Sushi Tokenomics Redesign proposal that was distributed by Tate on the Sushi.com forum (2), the protocol may change the underlying principles of reward distribution for liquidity providers (LPs) and xSushi payouts.

I am excited to share the vision for @SushiSwap's new token model. I've posted a brief tl;dr write-up on the Sushi forum & linked the entire proposal. We look forward to your questions & feedback.https://t.co/D9TO2Oi8ra pic.twitter.com/GBrQKPzfiH

— Jared Grey (@jaredgrey) December 30, 2022

Details of the Proposed Changes

LPs will be eligible for bonuses due to the 0.05% swap charge, but most awards will be given to the pools that see the largest trading volume. Locking awards can be done with LPs in order to increase their value.

Meanwhile, the rewards for LPs will be forfeited if the project is terminated before it has matured. Members of the XSushi community will be eligible to receive emissions-based benefits and can "soft locks" those rewards.

This means that the leverage can be eliminated before the rewards mature, but the rewards themselves will be lost. xSushi will receive emissions-based perks in time-locked tiers.

More points are rewarded for longer locks. In addition, a variable proportion of the 0.05% swap charge will be used to fund a repurchase scheme to reduce the total number of SUSHI tokens in circulation.

The precise percentage will shift depending on the number of time-locked levels chosen. The new emissions schedule, with a margin that is more dependable.

In addition, the SushiSwap team will initiate a price support program, and a percentage of the 0.05% swap charge will be set aside specifically for this endeavor.

Grey has mentioned that the team would aim for a modest 1-3% APY for emissions to maintain a balanced supply despite the numerous repurchases and token burn activities that will take place.

SushiSwap (SUSHI) became a top-tier DeFi protocol in 2020 as it sucked liquidity away from Uniswap (UNI) by giving superior yield farming rates.

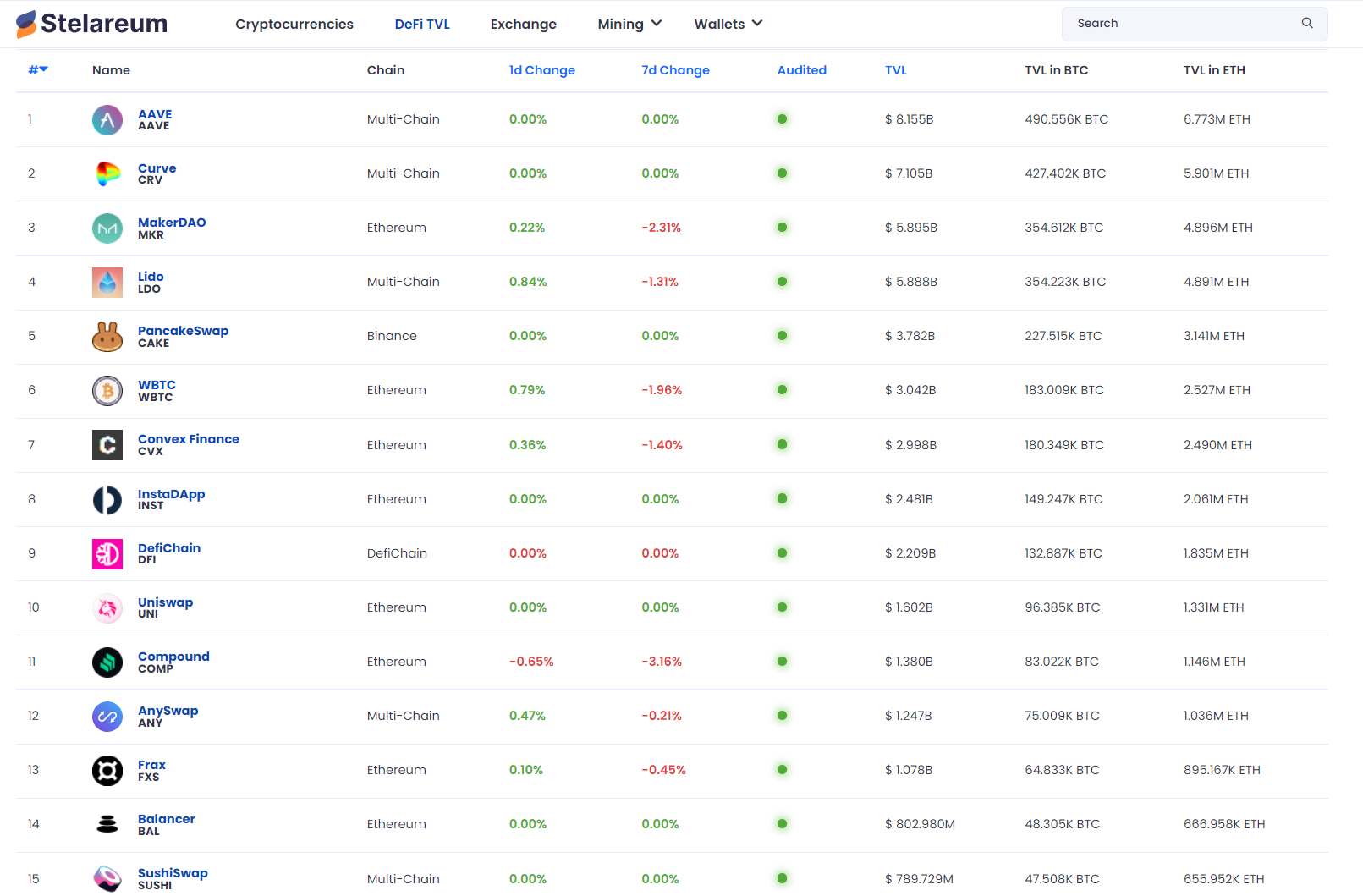

Uniswap was the prior top-tier DeFi protocol. The new leadership of the platform presented SushiSwap 2.0 in 2022, a modified version of the protocol's roadmap. As of the end of December 2022, it is the 15th most active DeFi protocol in terms of network activity, with a total of $ 789 million locked over numerous blockchains.

SushiSwap Token Price Trends

At the time of the writing, SUSHI was exchanging hands at $ 0.94. It has been oscillating between $ 2 and $ 0.9 since last 6 months. However, the token has lost more than 96 percent of its value since its launch.

It is expected that the effect of the new changes will lift the token from the all time lows that it is trading since some time now.