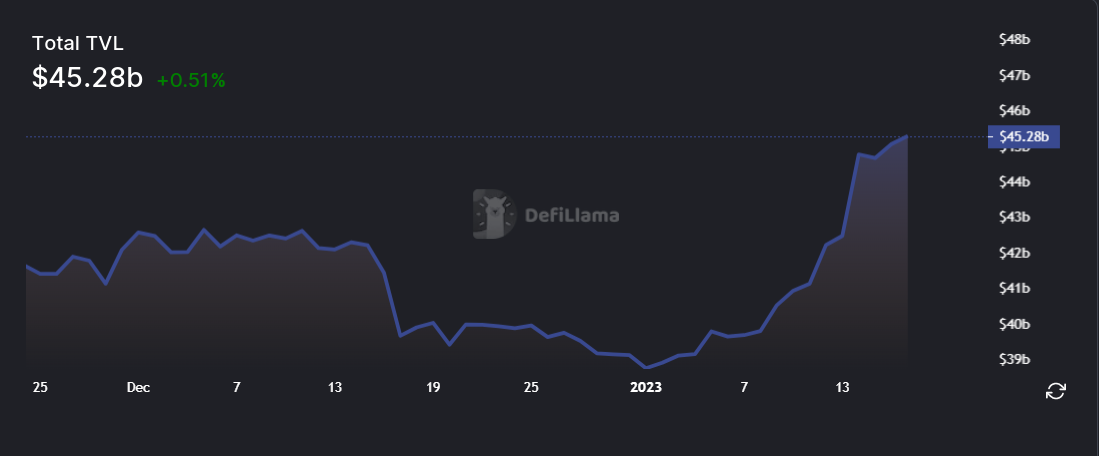

For the first time in ten weeks, the total value of the collateral being held in reserve by the DeFi procedures has surpassed Forty Five billion dollars. In addition, the total value locked (TVL) has increased by approximately twenty percent since the start of the year.

As per DeFiLlama (1), TVL is at its most significant level since November 11, when it was trading at $45.47 billion. Most of the critical DeFi protocols have had double-digit percentage increases in their security over the past week. Around $8.4 billion in new capital has been injected into the DeFi ecosystem since its cycle low on January 1.

However, a significant portion of this may be ascribed to increases in the performance of the underlying digital currencies as markets have shown signs of improvement. It is also important to remember that DeFi TVL was still 75% lower than in December 2021, when it reached its highest point.

Lido Leads in Terms of Market Share in the DeFi market

In addition to rising collateral prices, liquid staking derivatives have served as the primary force behind the movement of market prices. With a domination of 17.2% of the DeFi market, Lido now commands the greatest market share. In addition, it is quickly moving ahead of the previous leader in the DeFi market, MakerDAO, which currently holds a share of 13.25%.

Liquid staking myths drive interest in Lido and other services. This is expected to continue up to the Shanghai update, which will slowly liberate any ETH staked in a smart contract.

DeFi TVL also saw a significant spike, gaining $5 billion in assets. Lido was one of the biggest winners, gaining over 20% TVL, which can be explained by the regenerated interest thanks to the Shanghai upgrade: pic.twitter.com/YgYE4kzAJO

— Henrique Centieiro (@henriquecentiei) January 16, 2023

A researcher who goes by the name "ViktorDeFi" stated on January 17 that DeFi Prediction Markets are "arguably the most undervalued crypto theses for 2023."

Speculative marketplaces that enable users to speculate on the outcomes of future events and exchange their forecasts are known as prediction markets. They can be used for events such as the outcomes of sports games, the results of elections, the sales of a company's products, and so on.

To illustrate the expanding market for prediction-based protocols, he provided a few case studies, including Polymarket, Azuro, and Zeitgeist.

Crypto Narratives Alpha Series 💎 02

— Viktor DeFi 🛡🦇🔊 (@ViktorDefi) January 16, 2023

DeFi Prediction Markets are arguably the most underrated crypto theses for 2023.

A thread on positioning for the gold rush on DeFi Prediction Markets + some alpha drips for you.

↓🧵

Algorand Total Value Lock Surging

In addition, DeFiLlama noted that Algorand TVL has been on the rise throughout the last week, rising 123%. The Algorand blockchain network is designed to have a high throughput while focusing on decentralization and sustainability.

It presently has a TVL of $180 million, and five of the top six dominant DeFi protocols on the system have grown in the triple digits over the previous week. The ecosystem has gained a significant pace thanks to the efforts of AlgoFi, Folks Finance, the Pact DEX, and GARD.

Algorand's TVL has grown by 137% over the past 7 days, it is now within 18% of the previous all-time high pic.twitter.com/MrSJVFF9FS

— DefiLlama.com (@DefiLlama) January 15, 2023

Ethereum maintains its position as the gold standard in crypto currency, with a market capitalization of approximately 60% plus a large TVL of $27.22 billion.